Pelvic Floor Therapy

Is Pelvic Floor Physical Therapy Covered By Insurance?

Picture this: you’re scrolling through your health blog at 2 a.m., trying to wrap your head around pelvic floor physical therapy, and suddenly you stumble upon the million-dollar question, "Is pelvic floor physical therapy covered by insurance?" If your answer is a resounding "meh, I hope so," you’re in the right place. Let’s dive into the nitty-gritty of insurance coverage for pelvic floor physical therapy, break down the jargon, and make sense of how you can score the best care without breaking the bank. We’re about to blend practical insurance hacks with a holistic view of your pelvic health, all wrapped up in a Gen-Z and millennial-friendly vibe.

Quick Links to Useful Sections

- The ABCs of Pelvic Floor Physical Therapy

- Insurance 101: Demystifying Coverage for Physical Therapy

- Why Insurance Coverage Matters for Your Pelvic Health

- How Pelvic Floor Physical Therapy Gets Covered: The Nuts and Bolts

- 1. The Diagnostic Journey

- 2. Preauthorization: The Green Light Process

- 3. The Coding Conundrum

- 4. Out-of-Pocket Expenses and Co-Pays

- 5. Appeals and Denials

- Integrating Holistic Approaches with Insurance Needs

- Real-Life Tales: Navigating Insurance and Pelvic Health

- The Tale of Kelly: From Denial to Recovery

- Marcus’s Story: The Preauthorization Plug

- Lara’s Hybrid Approach

- Troubleshooting Common Insurance Hurdles

- Claim Denials

- Preauthorization Roadblocks

- Understanding Coverage Limits

- Billing Code Confusion

- The Financial Upside: When Insurance Coverage Makes a Difference

- Steps to Take: How to Confirm Your Coverage

- Step 1: Read Your Policy

- Step 2: Consult Your Healthcare Provider

- Step 3: Call Your Insurer

- Step 4: Document Everything

- Step 5: Appeal If Necessary

- Real-World Resources and Community Support: Your Next Steps

- Bringing It All Together: A Comprehensive View of Your Pelvic Health Journey

- Pelvic Floor Physical Therapy FAQs: Get Your Answers Here

- Your Path Forward: Embrace Empowered Pelvic Health

The ABCs of Pelvic Floor Physical Therapy

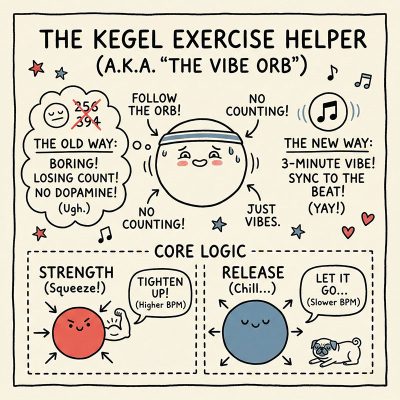

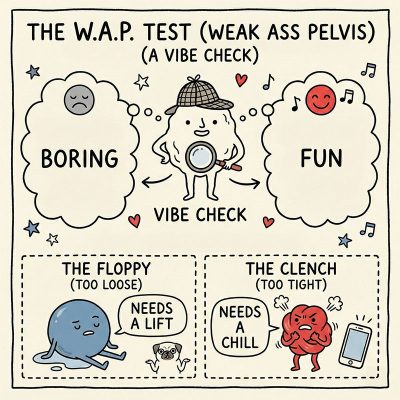

Before we dig deep into insurance policies and copays, let’s set the stage by exploring what pelvic floor physical therapy is all about. This specialized form of therapy isn’t reserved for new moms or folks recovering from surgery alone, it’s a powerful tool for anyone grappling with pelvic pain, incontinence, or even those just looking to optimize core strength and overall wellness. In essence, pelvic floor therapy involves targeted exercises, manual techniques, biofeedback, and sometimes even complementary modalities designed to strengthen, relax, or coordinate the muscles that support your pelvic organs.

The pelvic floor is a hidden powerhouse that often gets overlooked, but it plays a crucial role in stability, posture, and even sexual health. So when questions about insurance come into play, it’s not just about getting your workout plan covered, it’s about ensuring access to a treatment that can significantly enhance your quality of life.

Insurance 101: Demystifying Coverage for Physical Therapy

Let’s face it, insurance talk can feel like deciphering a secret code. But here’s the scoop: most health insurance plans cover pelvic floor physical therapy under the umbrella of outpatient rehabilitation, though the specifics can vary widely between policies, providers, and even states. Whether you’re rocking an HMO, PPO, or a high-deductible plan, understanding your policy’s language is crucial.

Insurance providers typically approach pelvic floor therapy like any other physical therapy service. They use standardized billing codes (known as CPT codes) to describe the treatment. These codes aren’t just throwaway numbers; they determine reimbursement rates, set coverage limits, and influence how preauthorization is managed. For instance, a common code used for physical therapy evaluation might be CPT 97001, while various therapeutic procedures might utilize codes like 97110 or 97112. If your provider uses these codes when billing your insurance, then there’s a good chance you may be covered, at least partially.

But here’s where things get interesting: coverage is often tied to medical necessity. What does that mean for you? Essentially, your healthcare provider will need to demonstrate that pelvic floor therapy isn’t just a “nice-to-have”, it’s a medically necessary service to manage conditions like pelvic pain, incontinence, or post-surgical recovery. So, if your symptoms have been causing you significant discomfort and interfering with your daily vibe, you’re more likely to get the thumbs-up from your insurer.

Why Insurance Coverage Matters for Your Pelvic Health

Imagine trying to fund an epic workout regime on your own, stressful, right? The financial side of pelvic floor physical therapy can be a daunting barrier for many. Insurance coverage helps bridge the gap between needing exceptional care and affording it. Whether you’re facing a steep copay or worrying about hitting your deductible, knowing your coverage details empowers you to take control of your health journey.

The benefits go way beyond just dollar signs on a billing statement. When your therapy sessions are covered, you’re more likely to attend regularly, stick to your treatment plan, and ultimately experience better outcomes. This kind of sustained, comprehensive care can lead to improvements in pain management, bladder control, posture, and overall core stability, making it a worthy investment in both financial and physical health.

For Gen-Z and millennial readers balancing student loans, rent hikes, and the pursuit of wellness, every dollar saved is a win. And when the frustration of declining pelvic health is paired with the reassurance of professional, insured treatment, it’s a recipe for enhanced quality of life.

How Pelvic Floor Physical Therapy Gets Covered: The Nuts and Bolts

So, how do you shift from wondering “Is it covered?” to confidently scheduling your therapy session? Let’s break down the process, step by step:

1. The Diagnostic Journey

Everything starts with a proper diagnosis. Your doctor or pelvic floor specialist will assess your symptoms, run tests if needed, and come up with a treatment plan that clearly spells out why pelvic floor therapy is medically necessary. This documentation serves as the foundation when you (or your provider) submit a claim to your insurance company.

2. Preauthorization: The Green Light Process

Many insurance plans require preauthorization before they agree to cover physical therapy sessions. Preauthorization means your healthcare provider must send in a request that details your condition, the proposed treatment, and the expected outcomes. Think of it as getting a hall pass in school, only in this case, it ensures you won’t have to pay out of pocket for sessions later.

This process might seem tedious, but it’s a critical step. When done right, it not only speeds up your path to starting therapy but can also prevent the frustration of claim denials later on.

3. The Coding Conundrum

As mentioned earlier, the billing side of physical therapy relies on CPT codes. These codes, like 97110 for therapeutic exercises or 97112 for neuromuscular reeducation, act as the shorthand that communicates your treatment plan to the insurance company. Your provider’s billing department will ensure the right codes are used so that your therapy sessions meet the coverage criteria.

4. Out-of-Pocket Expenses and Co-Pays

Even when therapy is covered by insurance, you might still encounter co-pays or co-insurance. Your plan might also have a maximum number of covered sessions per year, meaning if you exceed that limit, you could be responsible for additional costs. It’s essential to be proactive, review your plan or talk to a representative to understand exactly what your financial responsibility might look like.

5. Appeals and Denials

Unfortunately, even with all the proper documentation, your claim could get denied. This can be a massive headache, but don’t lose hope. Many denials are due to minor administrative errors or missing documentation. If your claim is denied, you have the right to appeal the decision. With a clear, evidence-backed appeal, often with support from your healthcare provider, you might just turn that denial into a win.

Integrating Holistic Approaches with Insurance Needs

We mentioned earlier that pelvic floor therapy isn’t solely about isolated exercises, it’s an integrated approach that balances conventional physical treatment with complementary methods. But here’s a twist: while insurance companies are more likely to cover clinical physical therapy sessions, many holistic practices (like yoga, meditation, or even acupuncture) aren’t always reimbursable. This raises important questions about how to blend these approaches.

The smart move? Use insurance to cover the clinically necessary sessions with a licensed pelvic floor specialist while supplementing your recovery with self-guided holistic practices at home. Many patients have created hybrid routines that combine insurance-covered physical therapy sessions with self-directed exercises, online classes, or community-based wellness programs. It’s a win-win: you get the best of both worlds while keeping an eye on your budget.

Some progressive insurers are even starting to recognize the benefits of holistic well-being, offering discounts or incentivizing sessions that include yoga or mindfulness training. It might be worth exploring if your plan has any such perks, which can further enhance your recovery without extra out-of-pocket costs.

Real-Life Tales: Navigating Insurance and Pelvic Health

Sometimes it’s easiest to understand a complex process through real-life stories. Let’s check out a couple of fictional, but totally relatable, scenarios that might sound familiar:

The Tale of Kelly: From Denial to Recovery

Kelly, a vibrant 28-year-old graphic designer, had been battling chronic pelvic pain for years. After several rounds of home remedies and online research, her doctor recommended pelvic floor physical therapy. However, when she first submitted her claim, her insurance company denied coverage by labeled her condition as “non-disabling.” Not one to back down, Kelly worked closely with her therapist to compile additional documentation and a detailed treatment plan. After a couple of calls and a formal appeal, her claim was approved, and she started a structured therapy regimen. Today, Kelly credits her improved quality of life to both her persistence and the integrated care she received.

Marcus’s Story: The Preauthorization Plug

Marcus, a 35-year-old tech entrepreneur, knew that pelvic floor physical therapy could help him manage post-surgical recovery following a prostate procedure. His insurance plan required preauthorization, so his healthcare provider meticulously prepared a packet justifying the necessity of the therapy. Marcus stayed in the loop by regularly following up with both his provider and insurer. With everyone on the same page, his preauthorization was smoothly approved, allowing him to begin his therapy sessions without a hitch. Marcus’s experience underscores the importance of clear communication and documentation in navigating the insurance maze.

Lara’s Hybrid Approach

Lara, a 32-year-old wellness blogger, decided to integrate both conventional therapy and holistic practices to address her pelvic floor issues. While her insurance covered the initial evaluations and a few therapy sessions, she complemented these with yoga classes and home-based mindfulness exercises. Lara’s balanced approach not only improved her pelvic health but also boosted her overall well-being. By strategically leveraging insurance for the most medically endorsed services, she managed to keep extra holistic practices affordable and accessible.

These stories highlight the variety of pathways available, whether it’s beating the insurance system with thorough documentation or supplementing professional care with holistic practices. The key takeaway? With the right information and proactive planning, accessing pelvic floor physical therapy doesn’t have to be financially overwhelming.

Troubleshooting Common Insurance Hurdles

Even with a solid understanding of the process, you might still bump into some roadblocks. Here are some common hurdles and tips on how to overcome them:

Claim Denials

Claim denials are the ultimate buzzkill. Whether it’s due to missing documentation, an error in coding, or a miscommunication between providers, denials can put your therapy journey on hold. The trick here is to stay calm and persistent. Request a detailed explanation for the denial, review your policy, and work with your provider to submit a thorough appeal. Keep records of all communications, it’s like having your insurance diary in case you ever need to refer back.

Preauthorization Roadblocks

Not all insurance plans require preauthorization, but if yours does, be prepared for a wait. Delays in preauthorization can stall your therapy sessions. We recommend contacting your insurer early and having your provider send in all the necessary documentation as soon as possible. Patience and a bit of follow-up phone calls can often expedite the process.

Understanding Coverage Limits

Some plans cap the number of sessions you can attend, which might mean that beyond a certain point, you have to pay out-of-pocket. It’s crucial to know these limits ahead of time. Ask your provider for an estimated treatment plan and share this with your insurance company. If you foresee needing more sessions, discuss alternative options such as home-based exercises or groups with your therapist.

Billing Code Confusion

Errors in billing codes can result in rejected claims or unexpected expenses. Don’t hesitate to ask your therapist’s billing department to explain the CPT codes being used. A clear understanding of which codes correspond to your specific treatment helps ensure that your claim is processed correctly.

By anticipating these issues and addressing them head-on, you can build a smoother pathway toward fully benefiting from your insurance coverage. It’s all about being informed, prepared, and proactive in your communication with both your healthcare provider and your insurer.

The Financial Upside: When Insurance Coverage Makes a Difference

Let’s talk numbers. Pelvic floor physical therapy can be a considerable investment if paid entirely out-of-pocket. Thankfully, good insurance coverage can lower your overall financial burden. For many, this means affordably accessing monthly sessions that lead to long-term improvements in quality of life.

Beyond the immediate savings, there’s a broader economic benefit, preventative care. By addressing pelvic floor dysfunction early, you can prevent more serious complications down the road (and trust us, those would cost way more). Consistent therapy sessions, funded through your insurance plan, translate into fewer emergency room visits, reduced medication needs, and even improved productivity and well-being.

In a world where every dollar counts, the fact that pelvic floor physical therapy might be partially or even fully covered by your insurance is a game-changer. It means that on top of physical relief and enhanced wellness, you’re also giving your wallet a well-deserved break.

Steps to Take: How to Confirm Your Coverage

Ready to find out if your insurance plan’s on board with pelvic floor physical therapy? Here’s a step-by-step guide to help you navigate this process with confidence:

Step 1: Read Your Policy

Start by diving into your benefits booklet or the online portal provided by your insurance company. Look for sections related to physical therapy or outpatient rehabilitation. Pay special attention to language around preauthorization, session limits, and co-pay requirements.

Step 2: Consult Your Healthcare Provider

Schedule a consultation with your pelvic floor specialist and ask them about their experience with insurance claims. A provider who’s well-versed in the specifics of coding and billing can be an invaluable ally. They know which documentation is needed and can even help you fill out necessary paperwork.

Step 3: Call Your Insurer

Don’t be shy, pick up the phone. Reach out to your insurance representative, explain your condition, and ask specific questions about coverage for pelvic floor physical therapy. Use this opportunity to ask about preauthorization requirements, session caps, and any out-of-pocket expenses you might face.

Step 4: Document Everything

Keep a record of all your communications, dates, names, and what was discussed. This documentation might come in handy if there are any hiccups with your claim later on.

Step 5: Appeal If Necessary

If your claim gets denied, don’t panic. Ask for a detailed explanation and work with your provider to prepare a formal appeal. Persistence is key; many patients have successfully turned a denial into a win with the right documentation and follow-up.

Following these steps can help you confirm your coverage with minimal stress, ensuring you’re fully informed before you embark on your therapy journey.

Real-World Resources and Community Support: Your Next Steps

Navigating insurance and pelvic floor therapy can feel overwhelming, but you’re not alone. There are robust communities and resources available to help you along the way.

Health forums, social media groups, and patient advocacy organizations are excellent places to get real-life advice from folks who have been in your shoes. Explore websites dedicated to pelvic health, attend virtual webinars, or even join local support groups that discuss holistic health strategies.

Additionally, many healthcare providers now offer educational seminars about insurance navigation and healthcare benefits. These sessions not only help demystify the process but also empower you to ask the right questions when speaking to your insurer.

Remember, investing time in understanding your insurance benefits is an investment in your overall well-being. By joining these communities and leveraging free resources, you empower yourself with knowledge, and that’s the first step towards holistic pelvic health.

Bringing It All Together: A Comprehensive View of Your Pelvic Health Journey

Ultimately, the question “Is pelvic floor physical therapy covered by insurance?” opens up a broader conversation about accessible, cost-effective healthcare. Through understanding your policy, working closely with informed healthcare providers, and supplementing clinical treatments with holistic approaches at home, you’re creating a dynamic, personalized plan for your well-being.

Think of your pelvic floor as the unsung hero of your body, a foundation that, when properly cared for, supports not just physical health but overall vitality. Tackling insurance intricacies is just one part of this journey, but it’s a critical step towards accessing quality care without financial stress.

By being proactive, informed, and persistent, you can transform what might seem like an intimidating maze of paperwork into a seamless part of your healing and wellness strategy. Every call, every document, and every follow-up is a step forward, empowering you to reclaim your health, protect your future, and rise above the complexities of modern insurance systems.

Whether you’re managing chronic pelvic pain, recovering from surgery, or simply taking steps toward better core stability, remember that your journey is unique. Celebrate the small victories, lean on community support, and trust that with the right knowledge and approach, you can navigate the insurance labyrinth and secure the care you need.

Pelvic Floor Physical Therapy FAQs: Get Your Answers Here

We’ve compiled some frequently asked questions to help clear up any lingering doubts about insurance coverage and pelvic floor physical therapy. Dive into these answers to boost your confidence as you navigate your own health journey.

1. Is pelvic floor physical therapy covered by most insurance plans?

Generally speaking, many insurance plans cover pelvic floor physical therapy under outpatient rehabilitation services, especially when it’s documented as medically necessary. However, coverage can vary depending on your specific plan and provider.

2. What documents do I need to provide to get preauthorization?

You’ll typically need a detailed diagnosis, a treatment plan from your healthcare provider, and any supporting documentation (like test results) that highlight the medical necessity of the therapy.

3. How do CPT codes influence my coverage?

CPT codes (like 97110, 97112, or 97001) are used by healthcare providers to describe the services rendered. Insurance companies rely on these codes to process claims and determine coverage levels.

4. What should I do if my claim is denied?

If your claim is denied, request a detailed explanation, review your policy, and work with your provider to submit a thorough appeal. Document every communication for future reference.

5. Can I still benefit from complementary therapies if my insurance only covers clinical sessions?

Absolutely. Many patients create hybrid treatment plans that combine insurance-covered pelvic floor physical therapy with self-guided mind-body practices, yoga, or other wellness techniques to enhance their overall recovery.

6. How often do insurance plans reassess coverage limits?

This varies by provider and plan. Some policies have annual limits on sessions, while others may renew coverage based on your ongoing medical needs. Always check with your insurer for the details.

7. Are there any discounts or incentives for combining holistic practices with standard physical therapy?

While insurance typically covers only the clinical therapy sessions, some progressive insurers or wellness programs offer discounts for complementary approaches like yoga classes. It pays to ask!

8. Can I switch providers if I feel my current therapist’s billing practices aren’t working for my insurance plan?

Yes, you have the right to consult with different providers. It’s important to find a therapist who understands both the clinical aspects of pelvic floor therapy and the intricacies of insurance billing.

Your Path Forward: Embrace Empowered Pelvic Health

When it comes to pelvic floor physical therapy, clarity is power. By understanding your insurance’s coverage details, working closely with knowledgeable providers, and blending both clinical and holistic strategies, you’re setting the stage for a healthier, more balanced life. You deserve care that not only addresses the physical symptoms but also respects your time, your finances, and your holistic well-being.

Take a deep breath and remember: every question you ask, from the details of your deductible to the benefits of a guided therapeutic session, is a step toward owning your health journey. With this guide in hand, you’re well-equipped to navigate the complex world of insurance coverage, ensuring you get the most out of your pelvic floor physical therapy while keeping financial surprises at bay.

Embrace the journey with confidence, knowing that every call, every appointment, and every follow-up is part of building a future where your pelvic health, and overall vitality, are firmly in your control. Let your empowered approach to both conventional healthcare and holistic well-being be the force that propels you toward lasting strength and success.

Your journey to enhanced pelvic health is uniquely yours, and now, armed with knowledge and actionable steps, you can stride forward with assurance. Here’s to a future where optimal health, financial clarity, and self-empowerment come together in perfect harmony.

Curious About Your Pelvic Floor? Explore our curated collection of insightful articles to learn more and take charge of your health.

- Pelvic Floor Basics

- Pelvic Floor Exercises & Workouts

- Pelvic Floor Kegel Exercises: Techniques & Benefits

- Advanced Pelvic Floor Workouts

- Pre/Post-Natal Pelvic Floor Routines

- Pelvic Floor Exercises for Men

- Pelvic Floor Therapy Techniques

- At-home vs Professional Pelvic Floor Therapy Options

- Diet & Lifestyle for a Healthy Pelvic Floor

- Pelvic Floor Health & Wellness

- Specialized Pelvic Floor Conditions & Treatments

Now back to the main article!