Pelvic Floor Therapy

Pelvic Floor Physical Therapy Insurance

Ever felt that your pelvic floor deserves a VIP pass to wellness but are stumped by the maze of insurance jargon? Buckle up, because we’re diving into the world of Pelvic Floor Physical Therapy Insurance, a space where smart health choices meet savvy financial coverage. This is not your grandma’s insurance talk; we're breaking it down with wit, wisdom, and a sprinkle of millennial sass to help you decode the policies that could be your ticket to holistic pelvic wellness.

Quick Links to Useful Sections

- Understanding Pelvic Floor Physical Therapy Insurance

- The Basics: What Does Your Policy Cover?

- Why Pelvic Floor Physical Therapy Matters (and How Insurance Steals the Show)

- The Intersection of Insurance and Holistic Healing

- Demystifying Common Insurance Terms

- Insurance Coverage: What to Look for When Choosing a Provider

- Navigating the Claims Process Like a Pro

- Integrating Holistic Approaches with Insurance Benefits

- Tech Tools to Aid Your Journey

- Maximizing Your Benefits: Tips for a Smoother Experience

- Real-Life Success Stories: When Insurance Meets Healing

- Case Study: Sarah’s Story of Postpartum Recovery

- Case Study: Michael’s Breakthrough After Pelvic Surgery

- Case Study: Jasmine’s Journey to Holistic Healing

- Understanding Cost Factors and How They Impact Coverage

- Expert Tips for Communicating with Your Insurance Provider

- Resources and Community Support: Your Next Steps

- Designing Your Personalized Pelvic Floor Therapy Insurance Plan

- Step 1: Assess the Gaps in Your Current Coverage

- Step 2: Align Treatment Options with Insurance Benefits

- Step 3: Set Measurable Goals

- Step 4: Regularly Review and Adjust Your Plan

- Financial Strategies for Managing Out-of-Pocket Costs

- Engaging the Digital Age: Online Resources and Community Tips

- Your Journey to Empowered, Holistic Pelvic Health

- Integrative and Holistic Approaches FAQs: Your Questions Answered

Understanding Pelvic Floor Physical Therapy Insurance

Navigating the health insurance labyrinth can feel like deciphering a secret code, especially when it comes to specialized treatments like pelvic floor physical therapy. Simply put, Pelvic Floor Physical Therapy Insurance is the part of your health coverage that helps pay for those essential therapies targeting pelvic floor dysfunction, incontinence, pelvic pain, and more.

With a growing understanding of pelvic floor issues, from postpartum recovery to chronic pelvic pain, insurance providers are beginning to recognize the need for coverage that supports both conventional physical therapy techniques and the integrative, holistic approaches many of us swear by. Whether you’re battling pelvic pain, incontinence, or just aiming for peak core performance, knowing how your insurance intersects with your therapy options is key.

In today’s post-modern world, where DIY health hacks and viral fitness routines rule social feeds, taking control of your pelvic health insurance means more than just reading your policy’s fine print. It’s about understanding the benefits, limitations, co-pays, and coverage details that enable you to invest in yourself without breaking the bank.

The Basics: What Does Your Policy Cover?

Before you start scrolling through endless blog posts or slide into your health advocate’s DMs, it’s essential to grasp the nuts and bolts of insurance coverage for pelvic floor physical therapy. Policies often include:

- Coverage for Initial Evaluations: Most insurance plans cover the first assessment sessions necessary to diagnose pelvic floor dysfunction. These sessions often include physical assessments, biofeedback tests, and sometimes imaging studies.

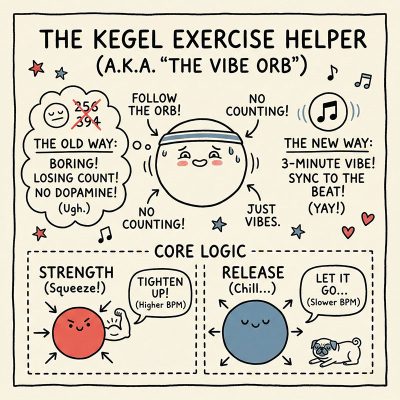

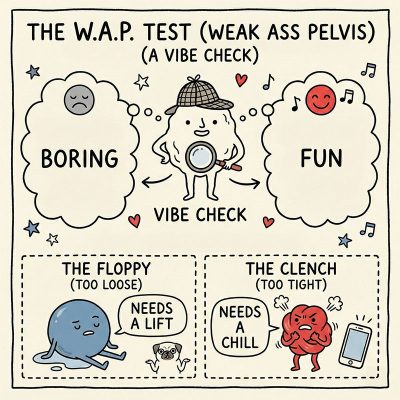

- Manual Therapy & Customized Exercises: Therapeutic sessions, including Kegels, reverse Kegels, and integrative core exercises, are sometimes covered, especially if they are part of a treatment plan prescribed by a specialist.

- Complementary Treatments: Some cutting-edge insurers are starting to recognize supportive therapies such as acupuncture, massage, or even mindfulness sessions aimed at reducing chronic pelvic pain. Check with your provider if these alternative approaches qualify.

- Follow-Up and Maintenance Sessions: Chronic conditions might need regular check-ups. Your policy may include a certain number of follow-up visits per year, ensuring you get ongoing support.

Key insurance terms like deductibles, copayment, and coinsurance play a major role in understanding how much you’ll have to cough up out of pocket. As always, the details are in your policy, so a good chat with your insurer or reading the fine print is a must.

For those of us who like to multitask while scrolling through our social feeds, keeping a cheat sheet of what to look for, a clear breakdown of benefits related to pelvic floor therapy, can save both time and money.

Why Pelvic Floor Physical Therapy Matters (and How Insurance Steals the Show)

Pelvic floor physical therapy isn’t just about exercises; it’s a game-changing approach to unlocking a healthier, pain-free, and more vibrant you. Understanding how insurance can support your journey means tapping into a pool of resources that could otherwise be a costly investment.

Think of it this way: investing in your pelvic floor is like investing in a premium gym membership for your core, and when your insurance steps in, you're basically getting a discount on that membership. Whether it’s postnatal recovery, managing the nuances of pelvic organ prolapse, or simply enhancing core stability, the right therapy can elevate your everyday performance.

And here’s the kicker: when your insurance covers those therapy sessions, it’s not just a financial win; it’s a holistic win. You’re empowered to explore integrative health options that blend conventional medical treatments with complementary therapies like acupuncture, massage, and mindfulness practices. This makes the insurance element not just a safety net, but a facilitator of comprehensive well-being.

The Intersection of Insurance and Holistic Healing

Let’s face it, more and more people are embracing a holistic approach to health, combining traditional therapies with alternative practices for a well-rounded, badass lifestyle. When insurance companies begin to recognize and cover holistic pelvic floor physical therapy methods, it marks a revolutionary shift in how we manage our health.

Health insurers are slowly catching up to the reality that pelvic floor health isn’t a one-trick pony. Instead, it’s a complex tapestry woven from physical therapy, mindfulness exercises, nutritional support, and lifestyle modifications. This integrative model is designed to reduce stress, improve core strength, and even elevate your overall mental health.

Many insurers are now offering policies that recognize these holistic approaches. This results in reimbursement for sessions that include not only targeted physical therapies but also supplementary treatments, such as guided meditation classes or yoga sessions tailored for pelvic strength. In other words, your insurance could very well become your holistic health cheerleader.

Demystifying Common Insurance Terms

Insurance language can feel like a foreign language, filled with acronyms and tricky terminology. Here’s a quick glossary to help you navigate the labyrinth:

- Deductible: The amount you pay out-of-pocket before insurance takes over. For instance, if your deductible is $1,000, you'll need to pay that before your therapy sessions start getting reimbursed.

- Copayment (Copay): A fixed fee you pay for each medical service, like a therapy session. It might be a small amount compared to the overall cost.

- Coinsurance: After reaching your deductible, you might split the cost with your insurer. For example, a 20% coinsurance means you pay 20% of the service cost while your insurance covers 80%.

- Out-of-Pocket Maximum: The cap on what you pay in a given year. Once you hit this limit, your insurer covers 100% of the remaining costs.

- Preauthorization/Referral: Sometimes, your insurance demands a prior approval or referral from a primary care provider before you see a specialist. It’s their way of saying, “We got you, but let’s double-check first.”

Understanding these terms not only boosts your confidence in managing your own healthcare but also helps you negotiate better with both therapists and insurers. Armed with this lingo, you can engage in discussions, ask the right questions, and ultimately choose the best plan tailored to your needs.

Insurance Coverage: What to Look for When Choosing a Provider

Choosing the right insurance provider is akin to picking a workout buddy who not only shares your goals but also understands your quirks. When it comes to pelvic floor physical therapy, there are a few critical factors to keep in mind:

- Network of Specialists: Does your policy include a robust network of pelvic floor therapists and specialists? The more in-network providers you have, the easier the claims process will be.

- Coverage Limits: Some policies limit the number of therapy sessions per year. Ensure that your plan offers enough sessions to meet your recovery and maintenance goals.

- Preauthorization Requirements: A good policy should have clear guidelines on preauthorization in a way that doesn’t add unnecessary hurdles.

- Inclusive Benefits: Look for plans that cover both conventional therapies and complementary alternative treatments, so you can enjoy a full-spectrum approach to pelvic floor health.

- Cost-Sharing Structures: Evaluate the deductibles, copays, and coinsurance details. Knowing what you owe at each step will prevent any nasty surprises later on.

Many Gen-Z and millennial policyholders are opting for digital-first insurers that provide transparency, user-friendly apps for claim tracking, and the ability to book appointments with specialists directly. These tech-savvy companies recognize that your time is valuable and streamline insurance processes to reduce hassle and confusion.

Navigating the Claims Process Like a Pro

Filing an insurance claim shouldn’t feel like you’re trying to hack into a secret government database. With the right tips and a little insider knowledge, you can master the claims process for pelvic floor physical therapy like a boss.

Start by keeping detailed records of all your therapy sessions, doctor visits, and any recommended home care practices. This documentation includes receipts, appointment summaries, and progress reports. These records are your lifeline should you ever need to dispute a claim.

Communication is key. Don't hesitate to ask your therapist or insurance provider to explain any terms or procedures that are unclear. Many insurers now offer online claim tracking tools that enable you to monitor your claim status in real time, eliminating the mystery behind any delays.

Pro tip: if a claim gets denied, don’t panic, just call your provider, understand the reason, and, if necessary, file an appeal with additional documentation. Often, a little persistence and a follow-up email can turn a denial into an approval.

Integrating Holistic Approaches with Insurance Benefits

Remember the scene from your favorite indie film where the characters come together to create their own unique solution? That’s exactly what integrating holistic methods with insurance-covered pelvic floor therapy looks like. It’s about combining targeted physical therapy with mindfulness practices, nutritional guidance, and even alternative treatments that add a holistic flavor to your recovery.

Many progressive insurance policies now extend to cover services like acupuncture, massage therapy, and even guided mindfulness sessions, all part of an integrative approach to healing. Activating these benefits can transform routine therapy sessions into comprehensive healing experiences. Imagine using a biofeedback device during your pelvic floor workout while also indulging in a stress-reducing meditation, talk about a win-win!

By blending conventional therapies with holistic elements, you’re not just treating symptoms; you’re addressing the root causes of pelvic floor issues. This comprehensive approach paves the way for sustained improvements and an overall boost in quality of life.

Tech Tools to Aid Your Journey

In the age of smartphones and smart everything, why not let technology play a part in your health journey? There are a host of apps and wearable devices designed to help track your pelvic floor exercises, monitor progress, and even remind you to hydrate and relax.

Some cutting-edge apps integrate with insurance platforms, allowing you to book sessions, track claims, and even receive personalized recommendations based on your therapy progress. These digital solutions make it easier to stay consistent and accountable, that daily reminder to do a set of pelvic floor exercises might just save your day.

Additionally, wearables can provide real-time feedback during exercises, ensuring you’re engaging the correct muscles. This tech-savvy approach aligns perfectly with a holistic treatment plan, making your journey interactive, engaging, and, dare we say, fun!

Maximizing Your Benefits: Tips for a Smoother Experience

Let's break down some actionable tips to ensure you’re squeezing the most out of your pelvic floor physical therapy insurance:

- Stay In-Network: Always verify that your therapist is within your insurance network, this minimizes out-of-pocket costs and simplifies the claims process.

- Ask About Bundled Services: Some providers offer bundled packages that cover multiple therapy modalities, which might include both conventional treatments and holistic approaches.

- Keep Detailed Logs: Document your sessions, exercises, and any home-based practices to support your claims and maintain a comprehensive progress record.

- Regularly Review Your Policy: As policies can change year to year, it’s a good idea to review your coverage details each renewal cycle.

- Utilize Digital Tools: Embrace the apps and online portals offered by many insurers, these can simplify booking, tracking claims, and even help you schedule your therapy sessions.

- Engage with Your Provider: Don’t hesitate to ask questions or request a clarification of your benefits. Being proactive can often open doors to additional coverage or streamlined processes.

These tips aren’t just suggestions, they’re power moves. By being an informed policyholder, you’re ensuring that you get the full benefit of your coverage, all while advancing your pelvic floor health without the stress of unexpected bills.

Real-Life Success Stories: When Insurance Meets Healing

It’s one thing to read about policy benefits and quite another to hear about real-life transformations. Let’s check out some success stories that demonstrate how the right insurance coverage can turn a pelvic floor nightmare into a journey of empowerment.

Case Study: Sarah’s Story of Postpartum Recovery

After welcoming her first baby, Sarah experienced discomfort and incontinence that clouded her postpartum recovery. With guidance from her obstetrician, she sought out pelvic floor physical therapy. Thanks to her comprehensive health insurance plan, which fully covered her initial evaluation, follow-up sessions, and even some complementary holistic practices, Sarah experienced both relief and a renewed sense of strength. Embracing a mix of traditional exercises and mindfulness strategies, Sarah went from feeling debilitated to embracing her body with confidence.

Case Study: Michael’s Breakthrough After Pelvic Surgery

Michael, a 48-year-old urban professional, faced a challenging recovery after undergoing pelvic surgery. His insurance policy, which extended robust coverage for physical therapy and integrative treatments, allowed him to access a specialized pelvic floor therapy clinic. With a custom treatment plan that included manual therapy, biofeedback, and yoga sessions, Michael’s recovery was faster than anticipated. His experience is a testament to how proactive insurance coverage can ease post-surgical challenges and accelerate holistic healing.

Case Study: Jasmine’s Journey to Holistic Healing

Jasmine had battled chronic pelvic pain for years, juggling conventional treatments with the hope of a long-term fix. When her new insurance plan began covering integrative therapies alongside traditional pelvic floor exercises, she saw an opportunity to try something new. With sessions ranging from acupuncture and massage to guided meditation and core-strengthening routines, Jasmine found herself not only alleviating pain but also rediscovering joy in movement. Her story highlights the promising synergy that exists when holistic therapies are embraced under a supportive insurance umbrella.

These stories prove that while the paperwork may be daunting, the tangible benefits of the right insurance can transform lives, providing access to advanced therapies, reducing financial burdens, and ultimately, paving the way to a healthier, more confident you.

Understanding Cost Factors and How They Impact Coverage

The cost of pelvic floor physical therapy can vary widely depending on your location, the complexity of your condition, and the specific therapies you pursue. Here are several cost factors to keep in mind:

- Initial Assessments: Comprehensive evaluations, including physical exams and biofeedback tests, tend to be more expensive but are critical for tailoring a personalized treatment plan.

- Frequency of Treatments: Chronic conditions might necessitate more frequent sessions, which can add up over time. Your insurance’s annual limits and session caps are key details to review.

- Type of Therapy: Some advanced treatments, such as electrical stimulation or integrative holistic modalities like acupuncture and yoga-based therapy, might come at an additional cost unless explicitly covered by your policy.

- Location and In-Network Providers: Therapists operating in major urban areas or those recognized as specialists might charge premium rates. Staying in-network can help mitigate these expenses.

Being aware of these cost drivers empowers you to make informed decisions when selecting a provider or negotiating with your insurance company. Moreover, if you have a flexible spending account (FSA) or health savings account (HSA), you might be able to allocate pre-tax dollars to cover out-of-pocket expenses.

At the end of the day, understanding these factors allows you to appraise whether your current plan meets your needs or if it might be time to shop around for better coverage that supports both your immediate therapy needs and long-term pelvic health goals.

Expert Tips for Communicating with Your Insurance Provider

Never underestimate the power of clear communication with your insurance provider, it's like having a backstage pass to your health benefits. Here are some expert tips to make your dialogue with the claim adjusters and customer service teams as smooth as your post-therapy relaxation routine:

- Document Everything: Whether it’s the dates of your sessions, detailed notes from your therapist, or copies of all correspondence, having a well-organized file is your secret weapon.

- Prepare a List of Questions: Think ahead about what you need to ask, from coverage limits to referral requirements. A list ensures you don’t forget a crucial detail during your call.

- Seek Clarification in Writing: If something is unclear, request an email confirmation. This documentation helps avoid any miscommunications or shifts in policy later on.

- Be Honest and Direct: Clearly explain your condition, the treatments prescribed, and your overall goals. Transparency can lead to a more productive conversation and smoother claim approvals.

- Use Digital Tools: Take advantage of online portals and apps where available. They offer convenience, faster responses, and real-time updates on your claim status.

By implementing these communication strategies, you’re not only managing your own health journey with confidence, but you’re also building a collaborative relationship with your insurer. It’s a dynamic interplay that can greatly influence the quality of care you receive.

Resources and Community Support: Your Next Steps

While understanding the complexities of pelvic floor physical therapy insurance might seem overwhelming, you’re not alone on this journey. A wealth of resources and supportive communities exists to help guide you every step of the way.

Start by tapping into online forums, social media groups, and wellness communities that focus on pelvic health. These spaces are often filled with stories, advice, and firsthand experiences on navigating insurance, selecting reputable providers, and even negotiating claims. Peer support can provide the extra boost of confidence your insurance queries sometimes need.

Additionally, consider reaching out to accredited pelvic floor specialists who often have a deep understanding of how different insurance policies operate. They can provide tailored advice and sometimes even assist with the paperwork. Many clinics now offer patient navigators, dedicated professionals who can demystify the process and ensure you’re taking full advantage of your benefits.

Don’t hesitate to explore government websites and trusted non-profit organizations dedicated to women’s and men’s health; these sources often provide up-to-date information on policy changes and innovative therapy options. Staying informed is your best defense against unexpected policy hurdles.

Finally, remember that you’re part of a larger community striving for optimal health. The more connected you are, the faster you’ll learn and adapt. Embrace this network of experts, peers, and advocates, it might just be the boost you need to take charge of your pelvic floor wellness.

Designing Your Personalized Pelvic Floor Therapy Insurance Plan

Crafting a personalized plan for pelvic floor physical therapy is like designing your ultimate self-care playlist, your favorite tracks, thoughtful pacing, and a rhythm that defines your unique journey. Start by evaluating your current health status, therapy needs, and the details of your existing insurance policy.

Here are some steps to get you started:

Step 1: Assess the Gaps in Your Current Coverage

Determine which services are fully covered, partially reimbursed, or not included at all. This honest self-assessment helps pinpoint where you might need additional resources, be it flexible spending options, supplemental insurance, or direct payments.

Step 2: Align Treatment Options with Insurance Benefits

Explore both conventional and holistic therapy options that align with what your insurer covers. For example, if your plan reimburses biofeedback sessions or manual pelvic floor therapies, tailor your treatment plan to maximize these benefits. At the same time, consider incorporating low-cost complementary practices like yoga or mindfulness meditation.

Step 3: Set Measurable Goals

Whether it’s reducing pelvic pain, improving urinary control, or simply enhancing core strength, setting clear, measurable goals will help you track progress. Document your progress in a digital journal or an app recommended by your therapist. This record may also be useful if you need to negotiate further coverage or modifications to your therapy plan.

Step 4: Regularly Review and Adjust Your Plan

Your journey to pelvic health is dynamic. As you progress, regularly review your treatment plan in light of new developments in your condition or changes in your insurance policy. A proactive approach means scheduling periodic consultations with your therapist and insurance advisor, ensuring your plan always reflects your current needs.

In essence, consider this process a living, breathing plan that adapts with you. With the right balance between therapeutic interventions and smart financial choices, you can build a roadmap to a healthier, more empowered you.

Financial Strategies for Managing Out-of-Pocket Costs

Even with robust insurance coverage, out-of-pocket costs can sometimes loom large. But fear not, a few savvy strategies can help mitigate these expenses while ensuring you never compromise on your pelvic floor health.

- Utilize FSAs and HSAs: Flexible Spending Accounts and Health Savings Accounts allow you to set aside tax-advantaged dollars for medical expenses. This means you can pay for therapies and even some complementary treatments with pre-tax money.

- Negotiate Payment Plans: Many clinics offer payment plans or sliding scale fees for patients who require extended treatment courses. Don’t shy away from asking, being upfront about your financial situation might unlock unexpected discounts.

- Maximize Preventative Care: Incorporating preventative strategies, such as daily pelvic exercises and mindfulness routines, can reduce the frequency and intensity of therapies required, ultimately minimizing costs.

- Bundle Services: If your insurance offers bundled services that include evaluations, therapies, and follow-up sessions, take advantage of these packages for a more cost-effective plan.

- Keep an Eye Out for Updates: Insurance policies evolve. Stay informed about changes in your coverage by subscribing to updates from your insurance provider or consulting a health policy advocate.

Financial mindfulness goes hand in hand with physical and mental mindfulness. By proactively managing costs, you’re not only protecting your wallet, you’re also ensuring that your health journey remains steady and uninterrupted.

Engaging the Digital Age: Online Resources and Community Tips

In our hyper-connected world, the intersection of digital tools and health insurance is more relevant than ever, especially for Gen-Z and millennials. Social media forums, blogs, and dedicated mobile apps provide a treasure trove of information on pelvic floor physical therapy insurance.

Look for online communities where users share experiences, reviews, and tips on navigating insurance coverage for pelvic floor therapy. These platforms often host Q&A sessions, live webinars, and virtual meetups led by health experts and patient advocates. They serve as digital support groups that offer real-time advice and even emotional encouragement during challenging times.

Additionally, many health insurers now offer intuitive apps that allow you to:

- Track your therapy appointment and coach you through exercises.

- File claims, view reimbursement statuses, and manage deductibles.

- Receive alerts on policy updates, new network providers, or bonus wellness benefits.

Leveraging these digital resources empowers you to take control of both your pelvic health and your financial well-being. The more informed and connected you are, the easier it becomes to navigate insurance complexities and optimize your therapy journey.

Your Journey to Empowered, Holistic Pelvic Health

Embracing a thoughtful, integrated approach to pelvic floor physical therapy insurance is about so much more than paperwork, it’s about taking charge of your well-being with knowledge, confidence, and a touch of humor. From understanding policies to communicating effectively with your provider, every step you take is paving the path to a healthier, more empowered you.

Picture your pelvic floor as the unsung hero powering your everyday life. When backed by robust insurance support, each therapy session, every complemented holistic practice, and every informed financial decision contributes to a foundation of strength and resilience. This journey isn’t just about managing symptoms, it’s about thriving, connecting with your inner self, and ultimately living life with freedom and confidence.

Whether you are just beginning to explore your insurance benefits or you’re a seasoned pro tweaking your optimal plan, remember: every inquiry, every session, and every mindful moment is a step toward lasting pelvic health. Embrace this transformative quest with humor, curiosity, and a readiness to learn, because your health, much like a cool new app update, is always evolving.

Take heart in knowing that with the right insurance coverage and a personalized, holistic approach, you have the power to sculpt not only a stronger pelvic floor but also a more vibrant, confident life. So get out there, ask the tough questions, invest in your well-being, and let your journey to empowered pelvic health inspire others along the way.

Integrative and Holistic Approaches FAQs: Your Questions Answered

Here are some frequently asked questions that address common concerns about pelvic floor physical therapy insurance and integrative treatment approaches:

1. What exactly is Pelvic Floor Physical Therapy Insurance?

It’s a part of your health insurance policy designed to help cover the costs of therapies addressing pelvic floor dysfunction, ranging from traditional physical therapy techniques to integrative methods like acupuncture and mindful exercises.

2. How do I know if my insurance plan covers pelvic floor therapy?

Review your policy details and speak with your insurance provider to verify if pelvic floor evaluations, manual therapies, and complementary treatments are included in your coverage. Many modern policies clearly outline these benefits.

3. What are common insurance terms I should be aware of?

Familiarize yourself with terms like deductible, copayment, coinsurance, and out-of-pocket maximum, they dictate how much you’ll pay for each session and the overall cost-sharing structure.

4. Can insurance cover integrative and holistic approaches?

Yes, some insurers now recognize the value of holistic care and may offer coverage for services such as acupuncture, massage therapy, yoga classes, and mindfulness sessions as part of a broader pelvic floor treatment plan.

5. What should I do if my claim gets denied?

Stay calm, gather all documentation of your sessions, and contact your provider for clarification. Often, a well-documented appeal can turn a denial into an approval.

6. Are there digital tools to assist with managing my benefits?

Absolutely. Many insurers offer mobile apps to track your claims, view coverage details, schedule appointments, and even access health resources, all to streamline your journey.

7. How can I maximize my insurance benefits?

Stay informed by reviewing your policy regularly, using digital tracking tools, keeping detailed records of your treatments, and engaging with both your provider and insurer to ensure you’re obtaining every benefit available.

8. Is there support available if I have questions about my coverage?

Yes, many insurance plans offer patient navigators or customer service representatives who specialize in answering questions about coverage, claims, and inclusive benefits for pelvic floor therapy.

9. Do advanced therapies like biofeedback get covered by insurance?

Often, yes. Biofeedback and other evidence-based interventions are increasingly recognized as valuable components of pelvic floor therapy and may be covered depending on your policy.

10. Can I incorporate holistic therapies at home with my insurance plan?

Many integrative practices such as mindful meditation, yoga, and targeted exercises can be done at home. Check with your insurance provider, as some plans offer reimbursements for digital programs or home-based therapy aids.

Curious About Your Pelvic Floor? Explore our curated collection of insightful articles to learn more and take charge of your health.

- Pelvic Floor Basics

- Pelvic Floor Exercises & Workouts

- Pelvic Floor Kegel Exercises: Techniques & Benefits

- Advanced Pelvic Floor Workouts

- Pre/Post-Natal Pelvic Floor Routines

- Pelvic Floor Exercises for Men

- Pelvic Floor Therapy Techniques

- At-home vs Professional Pelvic Floor Therapy Options

- Diet & Lifestyle for a Healthy Pelvic Floor

- Pelvic Floor Health & Wellness

- Specialized Pelvic Floor Conditions & Treatments

Now back to the main article!